The Financial Markets After the U.S. Election

After the British backed the Brexit option at the start of the summer, U.S. voters in turn confounded forecasters by choosing Donald Trump as their next president in early November. Most observers initially expected that scenario to trigger a big surge in concern that would hurt risky assets. In the end, the surge in anxiety lasted just a few hours on the evening of the election, and investors quickly focused on the fact that the president-elect’s campaign promises could result in stronger growth and higher inflation in the United States. The outcome was a quick jump in stock markets, bond yields and the U.S. dollar. Investors must now ask themselves whether these moves are justified and if recent market trends will continue.

Although the dust has settled a bit after the election, we must first recognize that much uncertainty remains about what policies the future Trump administration will actually implement. The president-elect is still in the process of putting together his team and only takes power on January 20. He seems determined to quickly announce a series of measures, but it could take several months before they start to impact the economy. There is however some consensus among elected Republicans on cutting taxes and eliminating certain regulations, which prompts us to expect slightly more sustained growth in the U.S. economy next year. Over the medium term, however, an erosion of public finances and introduction of protectionist measures could be less favourable for the economy.

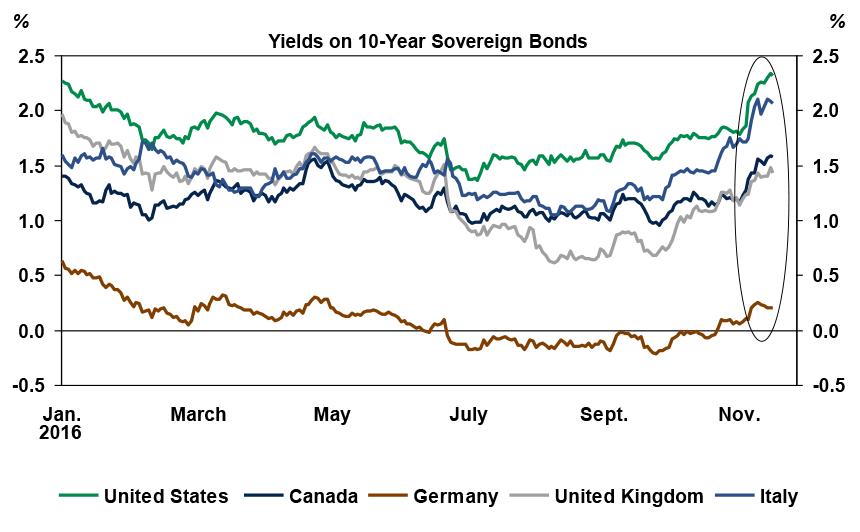

Under these circumstances, the upward adjustment in bond yields after the U.S. election seems justified. The yield on 10-year U.S. Treasury bonds was at 1.85% before the election and has since risen to 2.40%, its highest point since the summer of 2015. Similar moves have been noted in several other countries. The increases look swift, but they are partially due to the fact that extremely low bond yields in developed economies were already increasingly hard to justify. We had therefore observed a slight uptrend since the end of the summer. Donald Trump’s win acted as a catalyst for faster bond market normalization. Note that the president-elect has not been shy about his plans to implement aggressive measures to stimulate the economy and levy major tariffs on goods imported from China and Mexico, which will result in higher prices in the United States. This prompted investors to upgrade their inflation expectations, bringing them closer to the Federal Reserve’s target level.

The possibility that U.S. public finances will deteriorate sharply also justifies higher bond yields. Some analysts are predicting that the policies promised by Donald Trump could push publicly held U.S. federal debt to 105% of GDP by 2026, from the current level of around 75%. In this scenario, Moody’s and Fitch, the two credit rating agencies that still give U.S. debt a rating of AAA, could decide to downgrade its status. That being said, it is a long way from election promises to tangible measures, especially as some Republicans in Congress may not want to back a decline in public finances.

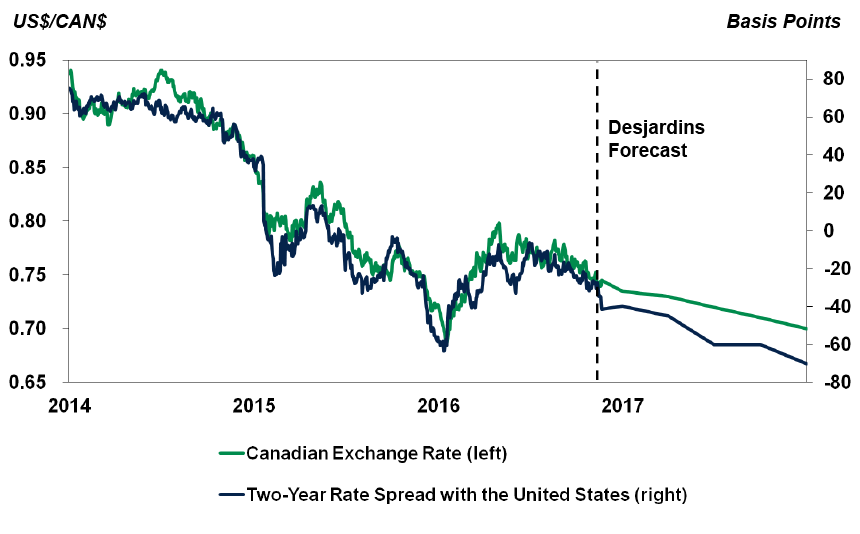

The possibility of higher inflation and more stimulating fiscal policy after the election are two additional arguments for monetary firming in the United States. A 0.25% increase in key rates at the December 14 meeting now seems almost guaranteed, and we are expecting two additional increases next year. Even faster monetary firming is now a possibility. Monetary policy divergence between the Federal Reserve and the other central banks, which will want to limit the upside pressure on their own bond yields, could be even sharper than we previously expected. This explains the U.S. dollar’s recent surge. We have therefore downgraded our outlook for the Canadian dollar, which could end 2017 at around US$0.70.

The upside adjustments of interest rates and the U.S. dollar therefore seem justified, and we think these trends could continue, albeit more slowly, in the coming months. The widespread upswing in risky asset prices, especially stock markets in advanced nations, is a little more perplexing. Clearly, the Donald Trump win seems good for some securities, especially financial sector stocks, which could benefit substantially from higher interest rates and regulatory easing. However, rising interest rates also lowers the present value of all future business profits, which could bring back fears of index overvaluation. Other factors, like the U.S. dollar’s strength and implementation of restrictions on trade and immigration, could also have a negative impact on businesses. All in all, keep in mind that the markets could be very volatile in the coming months. For now, our targets for the end of 2017 for the U.S. and Canadian stock markets are unchanged, still suggesting a return of about 8.5% next year, including dividends.

Sources: Datastream and Desjardins, Economic Studies

Sources: Datastream and Desjardins, Economic Studies Sources: Datastream and Desjardins, Economic Studies

Sources: Datastream and Desjardins, Economic Studies