Frequently asked questions

The quickest way to find answers to your questions is to check out our online resources.

Opening an account

Who can open an account at Desjardins Online Brokerage?

All Canadian citizens or residents aged 18 or over can open an account at Desjardins Online Brokerage. Unfortunately, we cannot open an account for non-residents.

How do I open an initial or additional account?

Choose from the following methods:

- Online: Complete the online formExternal link in less than 20 minutes, paperless and without postage delays, using your electronic signature. Certain types of accounts will require the forms to be mailed in. This will be specifically mentioned in the account opening process. Adding accounts (US currency, RRSP, TFSA, Options) for existing customers are done through the same process. Please note that new accounts will only appear online once they are opened. It may take a few days. Once opened, you must request (if applicable) the transfer of your positions.

- In a Desjardins caisse: Contact your Desjardins caisseExternal link to make an appointment. An advisor from this establishment will be happy to open an account for you.

How long does it take to open an account?

Once your forms have been completed, you should generally allow 48 hours before receiving your temporary password, which will allow you to access your account.

Is there a minimum investment required?

As an initial deposit, a cheque or transfer of at least CAD 1,000 is required to open an account. Cheques should be made payable to Desjardins Online Brokerage.

Can I fax you the documents required to open an account?

No, we only accept original documents duly signed.

Account management

How do I transfer an account?

To transfer part of your account at another institution or the entire account, you must fill out one of the transfer request forms listed and send it to us. You’ll also need to attach a copy of your most recent account statement using this form. We’ll forward your request to the other institution and ensure the transfer is completed.

- For a non-registered account transfer, use the D208 form.

- For a registered account transfer, use the VD212 form.

How long does it take to transfer an account?

Transfer times may vary depending on the institution and the investments being transferred.

The times listed are approximate and for information purposes only. During peak periods, transfers may take longer than expected to be completed. Missing or incomplete documents can also cause delays.

Within Desjardins:

- Your caisse: 3 to 10 business days

- Desjardins Insurance or Desjardins Financial Security: 20 business days

Brokers using the ATON system: 5 to 10 business days

Banks: 10 to 15 business days

Other institutions: 30 to 60 business days

How do I deposit share certificates to my account?

Simply sign the back side of the certificate, indicate your account number and send it to the address below, by registered mail. Certain fees apply. For details, see the fee schedules for the Disnat Classic and Disnat Direct platforms.

1170 Peel Street, Suite 105

Montréal, QC

H3B 0A9

How do I get a share certificate from my account?

You can request share certificates by email or by telephone. See the Contact Us page for our contact information. Applicable fees are deducted directly from your account.

When will I receive my monthly account statement?

Your statements are available online. You can access them by logging into your account on disnat.com, in the Documents section.

Please note that the account statement is produced quarterly when no transactions or operations have been made during a month.

Fees may apply if you wish to receive these by mail.

Is my account protected against broker insolvency?

Yes. In the event your broker goes bankrupt, the CIPF (Canadian Investor Protection Fund) ensures your cash and securities within defined limits. Visit the CIPF website This link will open in a new tab. for details.

Transactions

How do I pay for my transactions?

You can deposit funds to your account using 1 of the following methods:

- If you are a Caisse Desjardins member, you can wire funds using AccèsD

- Make a deposit at your local Desjardins caisse

- Mail in a cheque (see the Contact Us page for our mailing address)

- Transfer from your financial institution via their Bill payments function. To transfer funds this way, you must set up your account as a "payee" on your financial institution's website. For Desjardins Online Brokerage, specify "Valeurs Mobilières Desjardins" as the payee. Input your full 7-character account number as the payee account. You can use this function to transfer funds to your non-registered account and also to make contributions to your RRSP. You will need to set up separate "bill payees" to specify multiple accounts.

Please note that Desjardins Online Brokerage does not accept or electronically transfer funds to or from third parties.

I do not receive my confirmation slips by mail. How do I find them?

Confirmation slips are available online. You can access them by logging into our website, in the Statements section. Fees may apply if you wish to receive these by mail.

How can I allow someone else to trade in my account?

You and your agent (the person who will be trading on your behalf) must complete a Power of Attorney form (D104), available on our Forms page.

Is after hour trading available?

Yes, extended hours trading on the U.S. markets is possible from 8 a.m. to 9:29 a.m. and from 4:01 p.m. to 5:00 p.m. Learn more about extended hours trading

Transfers

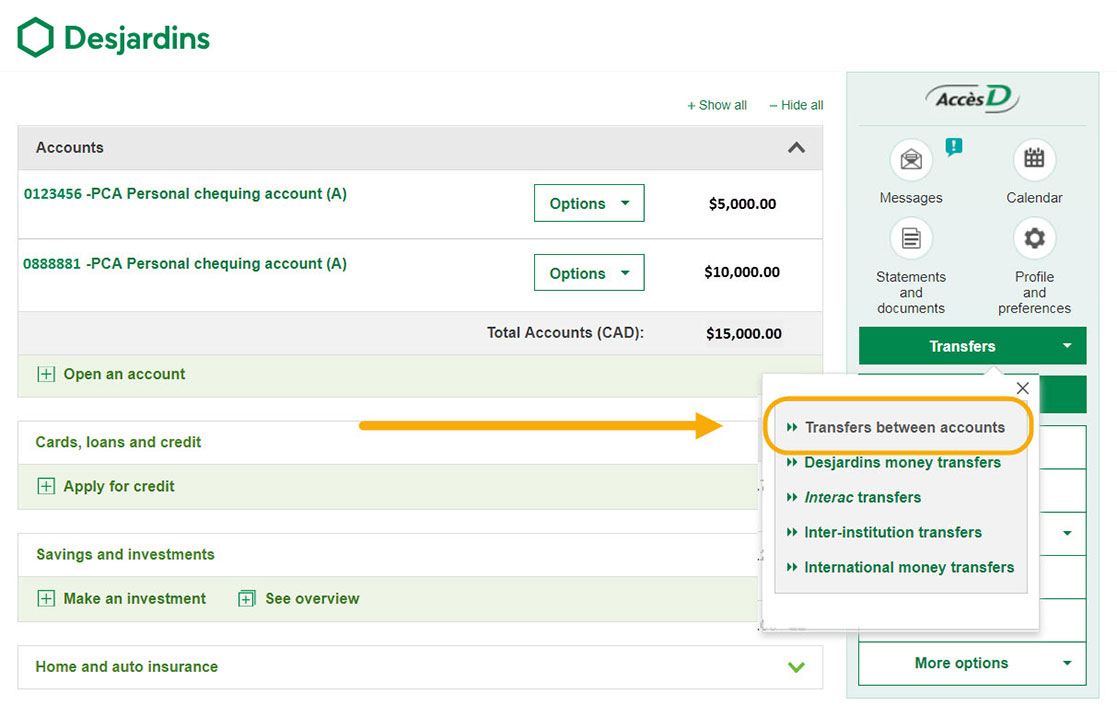

How do I transfer money from my caisse account to my Online Brokerage account in AccèsD?

If you're a Desjardins member, you can view your Desjardins Online Brokerage accounts under the Savings and Investments section in AccèsD and transfer funds between your accounts.

If you've just opened your account with DCL, note that there is a delay of 24 hours before your brokerage account is visible in AccèsD.

To make a transfer:

- Click Transfers

- Click Transfers between accounts

- Select the caisse account From and the online brokerage account To

- To contribute to your RRSP, select your RRSP online brokerage account

Your funds should be visible in your account on Disnat.com within approximately 10 minutes.

How do I make a transfer from an account at another financial institution to my Desjardins Online Brokerage account?

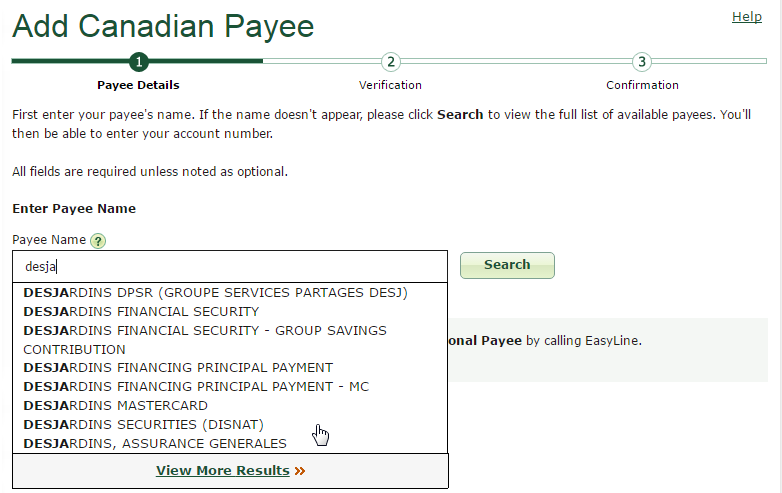

If you are a client of another financial institution, you can add a new payee by selecting Desjardins Securities, and entering your account number made up of 7 characters. You can then make your payment.

Your funds should be visible in your account on Disnat.com within approximately 48 hours.

How do I transfer funds between my brokerage accounts at Desjardins Online Brokerage?

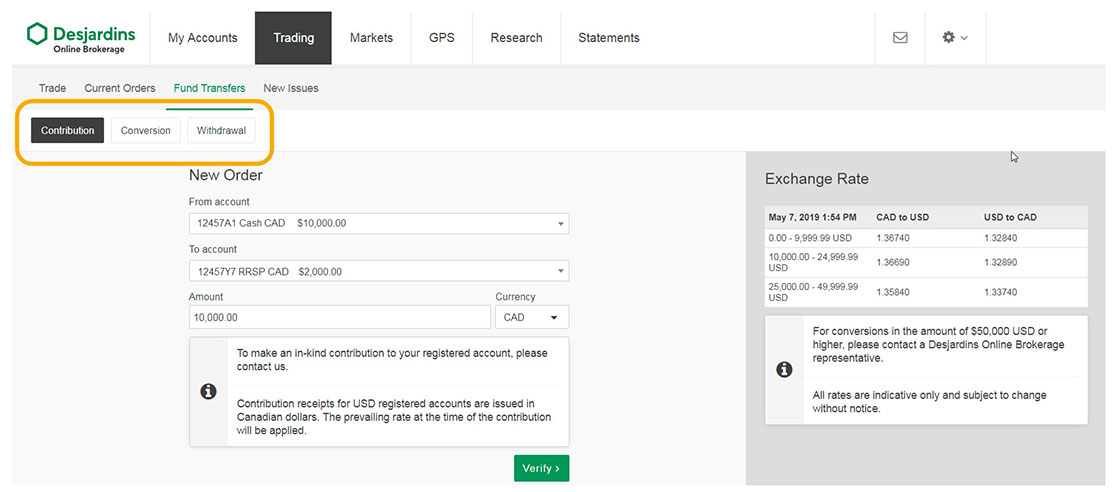

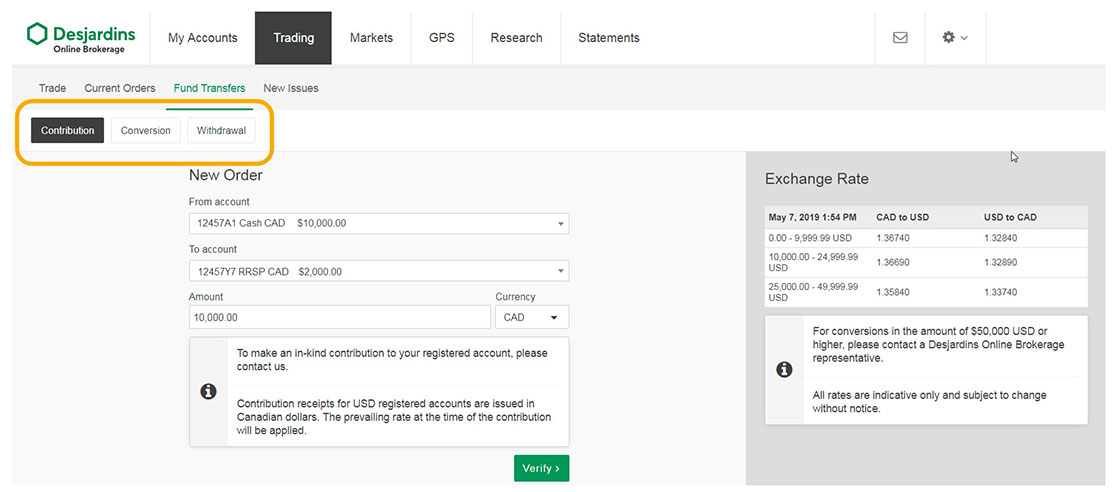

On Disnat.com, go to Trading, then Fund Transfers and select the type of transfer. You can contribute to your RRSP, TFSA and RESP accounts right from your non-registered online brokerage account.

Based on the type of request you submitted, it should take 24 hours for your transfer to be completed.

Transfer by your caisse

Are you having trouble transferring funds to your Desjardins Online Brokerage account? Did you know that your caisse can make e-transfers for you? Just ask them to make a transfer using the internal system SIPC.

How can I transfer money to my caisse or bank account?

You can make a direct deposit from your Desjardins Online Brokerage account into the account you provided a void cheque for when you opened your account:

- Click Trading

- Click Fund Transfers

- Choose the Withdrawal tab

- Fill out the form and select Direct Deposit

- Click Verify

This applies to withdrawals from cash, margin and TFSA accounts.

Trades

Can I place a trade when I don't have access to a computer?

You have 2 options: access your account through our mobile app or contact a client service representative, who will be happy to assist you. Visit our Contact Us page for our contact information.

Is there a minimum amount of shares required when I send an order?

No. However, you should consider the minimum commission per trade, i.e., the value of the trade compared to the minimum commission charged.

Do you offer real-time quotes?

Yes. To activate real time quotes, you must subscribe to this service and electronically sign the exchange user agreements on our website.

What are virtual trailing stop orders (VTSO)?

This type of order follows the price of a stock using a price spread, in essence tracking the price of stock as it rises or falls.

A trailing stop for a sell order sets the stop price at a defined spread below the market price. If the market price rises, the stop loss price rises by the same amount, tracking the stock, but if the stock price falls, the stop loss price remains the same. If the stock reaches the stop price, a sell order is triggered at market and filled at the prevailing market price. The reverse of this logic applies to VTSO buy orders.

VTSOs are an effective tool to let profits run in your account while cutting losses at the same time.

Example: You bought 100 shares at $10. The stock is now trading at $15. You want to protect yourself against a drop in the stock. Instead of a stop loss order at $13, you place a trailing stop with a stop spread of $2. The trigger price is calculated by subtracting the stop increment from the current price. In the order entry screen, you can click on the “trigger price” link to retrieve this information. In this example, the initial trigger price is $13. If the stock never goes higher than $15, a market order will be activated when the stock hits $13. If the stock goes to $16, the trigger price will become $14.

What is the difference between Level 1 and Level 2?

Level 1 provides real-time quotes, including the highest price, lowest price, bid, ask, volume, price of the last transaction and any price variation.

Level 2 indicates the depth of the market, allowing the investor to see orders behind the bid and ask for a given share and the origin of the orders according to the broker code.

Which markets can I trade on?

At Desjardins Online Brokerage, you have access to ECNs and market makers. This allows you to trade US stocks on the NASDAQ, NYSE, AMEX and the CBOE. You can also trade on the TSX Exchange, TSX Venture Exchange, CNSX, Neo Exchange and the Montreal Exchange (options) in Canada.

How can I get access to the Montreal Exchange (MX) to trade options?

You need to send us an email stating that you want to have access to the Montreal Exchange (MX).

What is the OTC market and do I have access?

It's an unregulated over-the-counter market. The only trading Desjardins Online Brokerage offers on this market is for American Depositary Receipts (ADR), which are traded by phone.

Tax Returns

Tax slips

If you deposited securities in an unregistered account during the year, you’ll receive the T5008 – Statement of securities transactions slip.

This slip shows, in box 20, the cost or book value, which is the initial cost paid or payable for securities or investments or the adjusted cost base (ACB).

See the document Statements and tax slips delivery dates.

When will I receive my income tax forms?

Tax forms are mailed within the first 60 calendar days of the following fiscal year. For trust units, statements are sent during the first 90 days of the following year. If you have registered for electronic statements, most of your tax slips will be available directly on your platform.

Securities without value that are no longer traded on the markets

Do you have a security without market value or a security with market value, which, for some reason, you have difficulty trading? Do you want to get rid of it so you don’t have to include it in your tax return for the current year?

You can ask to have a security withdrawn from your account by completing the This link will open in a new tab. Authorization to remove a security form. Please read the form carefully as it stipulates that once the transfer has been made, you may no longer claim ownership of the securities. You’re also responsible for consulting a tax advisor to find out if the transfer of securities to Desjardins Securities constitutes a disposition in accordance with the Income Tax Act.

Capital gains and losses

If you have securities you want to sell in order to include them in your tax return for the current year, make sure you do so before the deadline.

Foreign property

The foreign property report is a tool that can help you properly fill out CRA form T1135.

Form T1135 – Foreign Income Verification Statement is a control method used by the Canada Revenue Agency to ensure compliance with tax laws on reporting foreign-source income and to fight tax evasion. This requirement is for Canadian resident individuals, corporations, and certain trusts that at any time during the year, own specified foreign property valued more than $100,000, as well as certain partnerships that hold more than $100,000 of specified foreign property.

Since this requirement does not only apply to securities, it is important to speak with a tax specialist in order to make sure that every aspect of your wealth is covered.

For more information on the foreign income verification statement, visit the CRA website for This link will open in a new tab. Form T1135, as well as their This link will open in a new tab. Questions and answers about Form T1135.

RRSPs and TFSAs

Contributing to your RRSP or TFSA

On Disnat.com, go to Trading, then Fund Transfers and select the type of transfer. You can contribute to your RRSP, TFSA and RESP accounts right from your non-registered online brokerage account.

Based on the type of request you submitted, it should take 24 hours for your transfer to be completed.

In AccèsD, choose the Transfers option, then Transfers between accounts. Select the caisse account From and the online brokerage account To. Select your RRSP online brokerage account to contribute to your RRSP.

Your funds should be visible in your account on Disnat.com within approximately 10 minutes.

Contribution limits

Your annual RRSP contribution limit is equal to 18% of the income you earned the previous year, up to a maximum of:

| Year | Annual contribution |

|---|---|

| 2025 | $32,490 |

| 2024 | $31,560 |

| 2023 | $30,780 |

| 2022 | $29,210 |

| 2021 | $27,830 |

| 2020 | $27,230 |

| 2019 | $26,500 |

| 2018 | $26,230 |

To find out your total contribution room, refer to your notice of assessment sent by the Canada Revenue Agency (CRA) every year.

The deadline to contribute to your RRSP for the 2024 taxation year is March 3, 2025.

For more information about RRSPs, visit the This link will open in a new tab. CRA website.

Source: External link Canada Revenue Agency

| Year | Annual limit | Cumulative limit |

|---|---|---|

| 2025 | $7,000 | $102,000 |

| 2024 | $7,000 | $95,000 |

| 2023 | $6,500 | $88,000 |

| 2022 | $6,000 | $81,500 |

| 2021 | $6,000 | $75,500 |

| 2020 | $6,000 | $69,500 |

| 2019 | $6,000 | $63,500 |

| 2018 | $5,500 | $57,500 |

| 2017 | $5,500 | $52,000 |

| 2016 | $5,500 | $46,500 |

| 2015 | $10,000 | $41,000 |

| 2014 | $5,500 | $31,000 |

| 2013 | $5,500 | $25,500 |

| 2012 | $5,000 | $20,000 |

| 2011 | $5,000 | $15,000 |

| 2010 | $5,000 | $10,000 |

| 2009 | $5,000 | $5,000 |

For the maximum amounts in the table, we assume that the client was 18 years or older in 2009 and that they were eligible to contribute.

External link Information about TFSA contribution room

Contributing to your TFSA

The first days of the year are generally very busy for our client service department, since it’s when many clients decide to get their financial affairs in order. Take note that you may contribute to your TFSA at any time during the current year.

You can also avoid the bustle by contributing to your TFSA online through your financial institution or on Disnat.com.

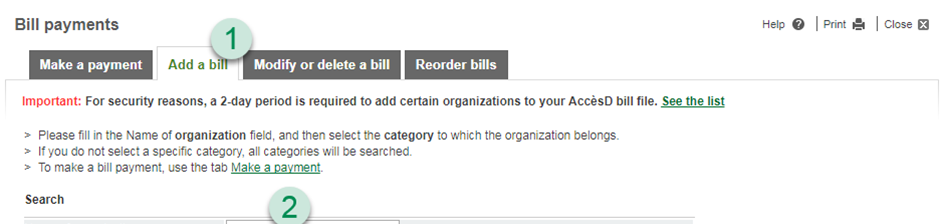

Contributing to a spousal RRSP through AccèsD

To make a contribution to an RRSP for the benefit of the spouse or common-law partner (“contributing spouse”), the latter must have previously opened a “spousal” type RRSP account. Then, you must use the Pay feature in AccèsD.

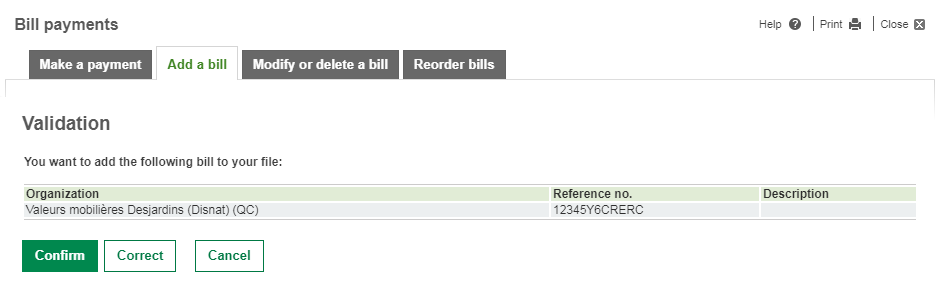

- Click the Add a bill tab

- Type in Disnat

- Click Search

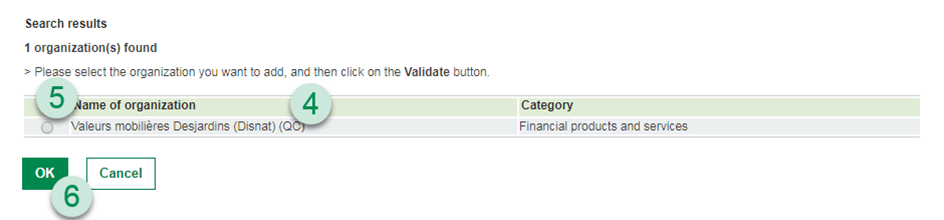

Once the payee information appears on the grey line (4), select that payee (5) and click OK (6).

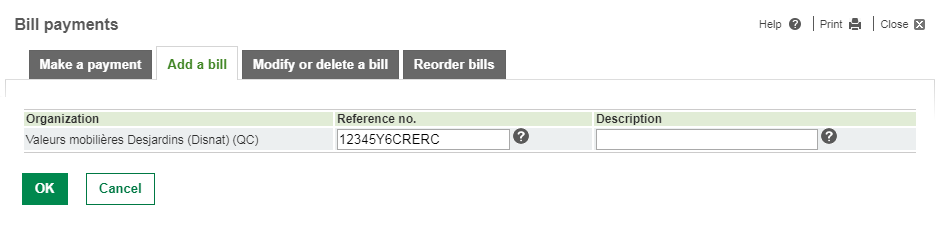

In the Reference no. box, enter your spouse's spousal RRSP account number and add the letters CRERC at the end. Click OK.

Caution: If the RRSP that receives the contribution in favor of the spouse is not of the “spousal” type, the tax consequences could be significant and irreversible. Please ensure that the contribution is made to the appropriate account.

Click Confirm

You’ll see the following message: Your bill has been added.

Site Access

How can I learn more about using your site?

Our Help section is quite user-friendly and clearly explains the functions on the site. You can also attend our many webinars from the events calendar and consult the videos in the Learning section of our website.

As a client, can I access my account using my computer at work?

Yes, as long as the computer meets the minimum system requirements. Also, make sure that you do not have a firewall or Internet security that would prevent any data transmission.

How can I change my password?

To change your password you must log in to your Disnat platform and go to "Profile". Input your new password and click "Save Data".

I forgot my password, how do I access my account?

Click on the "Forgot your password?" link on the login page.

If you do not receive an automated message from us, you should check your spam folder. If you are an AccèsD customer and you are no longer certain of your user code for your Desjardins Online Brokerage access, consult the Transfers between accounts section on AccèsD to see your brokerage accounts.

How can I update my address?

There are 2 easy ways to update your address:

- Enter your new address in AccèsD, under the Profile and preferences tab, and have the change applied to your Desjardins Online Brokerage account.

- Call Desjardins Online Brokerage customer service at 1-866-873-7103.

For security purposes, you cannot update your address by email.

How can I access the Disnat Direct trading platform?

Using the platform requires a certain familiarity with investing and technology as well as the ability to learn independently. Disnat Direct is designed for investors who:

- Trade more than 10 times per month

- Wish to access an advanced trading platform with streaming market data and charts

- Wish to access "point and click" trading

Before getting started on the platform, check out our Learning page. Then, send in your request This link will launch your default email softwareby email. Additional fees might apply for using Disnat Direct. See our fees section for more details.

What's a single-use security code?

It's a 6-digit code that's sent to you by text or email and makes your login more secure. It's valid for 10 minutes. If you go over the time limit, you can get a new code by selecting Get a new code.

If I don't have access to a phone to receive my security code, can I still log in to my account?

You can receive your code by email by selecting Verify your account another way. You might have to wait several minutes before you receive your code by email.

What should I do if I haven't received the code by text message?

Make sure your mobile device can make calls and that you're in an area covered by your mobile service provider. You can try again by selecting Get a new code.

If you still haven't received your code after 2 attempts, you can choose to receive it by email by clicking Verify your account another way.

Note that single-use security codes can only be sent by text to phone numbers in North America (Canada, US).

Can I disable 2-step verification?

No, 2-step verification is mandatory for everyone.

Can I enable 2-step verification for every login?

Yes. You can enable 2-step verification for every login by unticking the box labelled Don't ask again on this device.

Why do I get a single-use security code request every time I log in?

Whenever you delete your cookies, all your saved passwords are erased. After deleting them on a device you trust or that belongs to you, you have to verify your identity again. Once your identity's been verified, you won't have to enter another single-use security code the next time you log in. However, this step will have to be repeated every time you delete your cookies.

Note that some devices may automatically delete cookies.

Didn't find the answer you were looking for?

Help and contact

See how you can contact us.

Contact us