The Bitcoin Frenzy Reaches New Heights

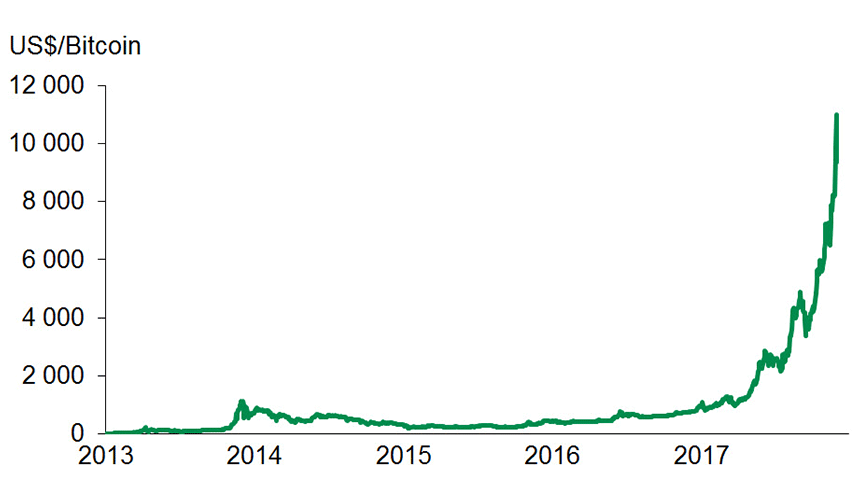

Bitcoin and its meteoric rise made the headlines recently. The value of a Bitcoin soared past US$11,000 on November 29, an appreciation of 1,000% compared to its value of $1,000 at the beginning of the year. The situation was even more ludicrous back in 2013, when its value skyrocketed from US$13 to US$1,000, or an appreciation of 8,000%. Bitcoin's value then fell back to around US$200. Will we soon see another major correction?

When it comes to Bitcoin, it's hard not to think about a speculative bubble. Since early 2013, its value has multiplied by more than 800. This is clearly more than the multiple of 5 seen on the NASDAQ during the dot-com bubble in the 1990s, and the multiple of 20 experienced during the tulip mania that swept the Netherlands in 1636–1637. The Bitcoin craze has far exceeded the obsession over tulips nearly 400 years ago.

Aside from the hope of major gains, little else explains this frenzy for Bitcoin that has been bubbling for a few years. Demand may have been encouraged recently now that some financial institutions are considering making it easier for their clients to access Bitcoin and creating a derivatives market for this cryptocurrency. However, when it comes to the real economy, Bitcoin and similar virtual currencies are rarely used to purchase goods or services.

Those who claim that its appreciation reflects its superiority over traditional currencies are on the wrong track. A solid currency cannot show such strong volatility. It would destroy the economy. Imagine that you took out a 300 Bitcoin mortgage at the beginning of the year to buy a house (a value of around C$400,000). Let's assume an attractive interest rate of 0% and a monthly payment of 1 bitcoin over 25 years. Today, your mortgage payment would still be 1 bitcoin per month, but it would cost you the equivalent of more than C$12,000 to pay it. In other words, you would likely be bankrupt. If every household, business and government were in the same situation, the global economy would be facing the worst economic crisis in history.

In economic jargon, a currency that continually goes up in value is known as a deflationary currency. The cost of goods and services priced in this currency have to be downgraded constantly. The same would apply to salaries and asset values, unless labor and capital productivity were to reach stratospheric levels. Meanwhile, debts do not benefit from deflation; their weight simply increases. And this of course discourages consumer credit. The best bet is to keep saving and wait for prices to drop. This is the big drawback of Bitcoin. To solve this issue, Bitcoin holders would have to agree to lift the ceiling on Bitcoin's supply and adjust the supply based on demand, as the central banks do. It would be very surprising if this were to happen.

Bitcoin has other inconveniences as well, such as the absence of regulations. Deposits in Bitcoins are not covered by deposit insurance and if an account is hacked, no compensation will be made and transactions performed without our knowledge cannot be reversed. Tracking Bitcoins is also tough to do, which makes it the currency of choice for illegal trade and tax evasion. Lastly, the Bitcoin network is already suffering from a lack of processing capacity, and finding a solution that is acceptable to all Bitcoin users has proven to be difficult. This is in fact what led to last summer's creation of Bitcoin Cash, a fork in Bitcoin but with different programming that allows more transactions to be processed.

Despite Bitcoin's weaknesses, some may still want to keep speculating on its value. Its sharp increase clearly looks like a bubble, one that could inflate even further. However, those who are willing to take their chances have to recognize that they are doing so at their own risk!

Instead of speculating on the Bitcoin's value, it might be better to focus on the blockchain. This is the technology behind cryptocurrencies like Bitcoin; technology that could be transferred for more productive use in the broader economy. Many believe this technology has huge potential. A blockchain is a public ledger of transactions that ensures the balancing of all accounts, simultaneously. No human checks and balances are required, unlike many of the transactions we carry out today.

Sources: Bloomberg and Desjardins, Economic Studies

Sources: Bloomberg and Desjardins, Economic Studies