Debt Remains a Problem

Despite significant improvements in some countries and sectors, the global debt problem persists, posing a major risk to future economic growth. This risk is exacerbated by the recent uptrend interest rates, which could put pressure on borrowers.

Global Debt Hits New Record

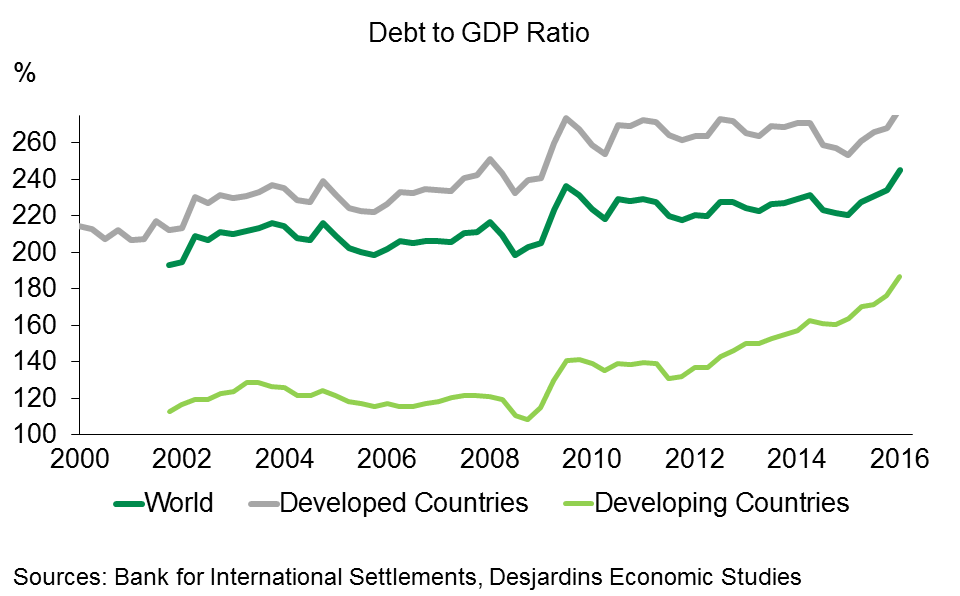

According to data compiled by the Bank for International Settlements, the combined debt of households, governments and non-financial businesses around the world has reached a new record high of around 250% of GDP (Chart 1). Unsurprisingly, developed countries are the most indebted, with an average of close to 280% of GDP. Developing countries stand out with a strong acceleration of debt in the last few years.

An examination of the data by borrower category reveals that, in developed countries, government indebtedness has shot up while average household and business debt has edged down since 2008. This is not the situation in developing countries, where primarily corporate debt has increased.

For Households, the Situation Has Not Improved Everywhere

Before the 2008–2009 financial crisis, the U.S. household debt load was nearly 100% of GDP. It is now under 80% of GDP. This downtrend has been noted in other developed countries but, in some cases, the reverse has occurred.

For example, in Canada, Norway and New Zealand, household debt loads are now akin to what they were in the United States prior to the 2008–2009 crisis. Levels are even higher in Australia and Switzerland, and the trend seems firmly entrenched. Households in Denmark and the Netherlands also have very high debt loads, but the trend has been declining for a few years now.

China is Catching Up to Developed Countries

China seems like a special case in terms of debt loads. Total Chinese debt is in the neighbourhood of 255% of GDP, much higher than other major developing countries and very close to the average for developed countries. Its indebtedness ratio is slightly higher than in the United States (253% of GDP), but lower than in the Euro zone (271%).

As with many developing countries, Chinese debt is growing primarily because of the business sector, and now exceeds G7 nations. If we include household debt, Canada edges ahead of China as Canada leads the G7 nations for private sector indebtedness (Chart 2).

More Exposed to Adverse Shocks

Heavy indebtedness alone does not guarantee a financial crisis or a recession, but it certainly makes the economy more susceptible to adverse shocks. The low interest rates of recent years have probably helped debt to increase without a substantial rise in default risk. Nonetheless, we can now worry about the new uptrend in bond yields around the world. If this rebound were to gain too much strength, many borrowers could find themselves under pressure.

Aside from interest rates, another shock could come from a drop in real estate prices or incomes. A potential surge in protectionism in the United States could also trigger another global economic slowdown, which would be exacerbated by the high debt rates.

Monetary and Fiscal Intervention More Difficult

During the 2008–2009 crisis, many governments responded to slowing demand with major stimulus plans. If a new crisis arises today, many governments are much more limited in their capacity to increase spending, given their already high debt loads.

Several central banks would be equally powerless, exposing the economy to a stronger contraction in the event of another crisis. Few central banks currently have significant leeway to lower their key rates. Resorting to policies involving massive asset purchases could still be considered, but leeway has also declined there. Moreover, it is very difficult to stimulate credit when indebtedness is already very elevated. At best, central banks could attempt to buy time by keeping interest rates low, even long-term rates. On another note, direct money creation, commonly called helicopter money, could be considered more seriously, especially if the risk of deflation increases. Heavy debt and deflation are not a good combination for the economy.

Over the long term, the solution would still be to actually reduce debt loads. Ideally, the reduction would occur very slowly, to minimize potential negative impacts on economic growth. When it comes to indebtedness, nothing is straightforward, and it often feels like walking a tightrope.

Global Debt is Nearly 250% of GDP

Canada is Ahead of China and the G7 Nations for Total Private Sector Debt