Discover the new Desjardins Structured Notes

See Structured NotesGet higher potential returns while your initial investment stays safe

Safely take advantage of the return potential of specific market views with our principal protected structured notes.

The advantages of principal protected structured notes

-

Security

Principal 100% guaranteed at maturity

-

Market return potential

Higher than traditional fixed-income products (e.g. GICs), and unique market exposure, tailored by the structure of the note

-

Liquidity and flexibility

Redeemable, in whole or in part, various terms available, although fees may applyfootnote 1

What are principal protected structured notes?

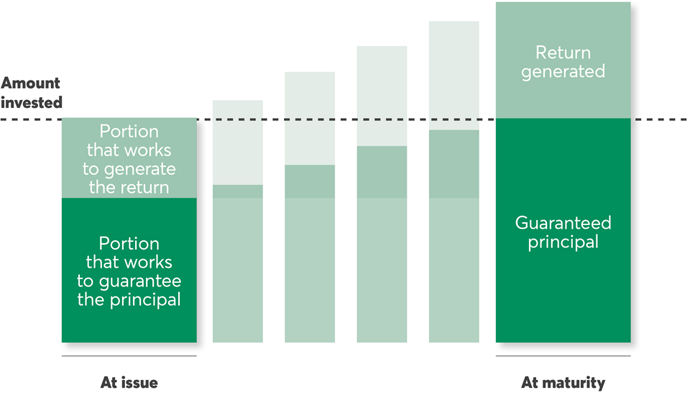

They are investments with two key components:

- One component guarantees your initial investment will be returned to you at maturity

-

A second, market-linked component offers the possibility (not a guarantee) of a return based on the performance of the note’s underlying asset and other features

- The underlying asset (or reference portfolio) can be different types of securities such as an exchange-traded fund or a set of market securities

- The features, such as participation ratefootnote 1 or return formula, may vary

Investors can redeem their notes, in whole or in part, with certain conditions. Fees may apply.footnote 2

Fully guaranteed principal

Why choose principal protected structured notes offered by Desjardins?

These investments can be great complements to conventional investment solutions. Featuring a different return-risk profile than fixed-income or growth products, they allow you to diversify your portfolio.

The Desjardins difference

A strong leader with over 25 years of experience in the structured product market, Desjardins offers distinctive investment solutions. Each investment solution is structured to use different features (calculation formulas, geographic exposure, etc.) that will optimize your exposure based on anticipated market views and thus meet the specific needs of investors.

Below are two examples of structured notes that Desjardins developed based on different—yet specific—market views:

-

With a higher participation rate

- Specific market view: stable or moderately bullish

- Advantage: possibility of unlimited returns and amplified participation

-

With an "Optimal Start" calculation formula

- Specific market view: correction in the markets at the beginning of the investment period followed by a rebound

- Advantage: Benefit from the best entry point and thus maximize return potential

See the complete list of This link will open in a new tab. Desjardins Structured Notes.

Notes

- The participation rate is the percentage of the reference basket's return used to calculate the investment return.

- Desjardins Securities Inc. intends to maintain, under normal market conditions, a daily secondary market for the notes, but is under no obligation to facilitate or arrange a secondary market, and in its sole discretion, may stop maintaining a market for the notes at any time, without any prior notice. To the extent that an available secondary market does exist, an investor may be able to sell a note, in whole or in part, subject to an early trading fee.